"State of Borrower Experience" Report Uncovers Pain Points Within Mortgage Process, Offers Insights for Lenders to Meet Borrower Expectations, and Encourage Repeat Business

SAN FRANCISCO, CA – August 24, 2022 – Mortgage lenders know they must offer a superior experience to acquire repeat business and earn customer referrals. Yet the mortgage process remains stressful for borrowers, with 1 in 5 reporting an issue with their transaction. New research from Snapdocs and STRATMOR Group released today bridges that gap, uncovering common pain points during the mortgage process and offering recommendations for lenders to improve the borrower experience. To see the full results, please download the “State of Borrower Experience” report.

“Lenders need to find new ways to compete for business in this market. While one proven strategy is to create a best-in-class borrower experience, there’s no consensus on what ‘best-in-class’ means, much less how to measure it,” said Garth Graham, senior partner at STRATMOR Group. “This research provides a granular view into the key ‘moments that matter’ so that lenders can begin to build their CX strategies around empirical data.”

The report surveyed more than 7,000 U.S. borrowers, all of whom completed a mortgage transaction in the previous nine months. The findings show that investing in technology and process improvements downstream in the mortgage process can improve borrower experience. Key findings include:

- Borrowers are generally happy with the application process: Fewer borrowers experience difficulties in filling out the loan application compared to other steps in the mortgage process. 67% of respondents rated the experience of filling out a loan application an 8 or above on a 10-point scale.

- Document collection and processing issues damage borrower experience: Unreasonable document requests caused a drop of 70 points in NPS, the most significant hit to the borrower satisfaction throughout the entire mortgage process.

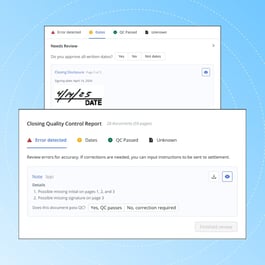

- Borrowers experience more frequent and significant issues during closing: More than one in three respondents experienced an issue during closing, dropping NPS by 34 points; respondents cited lack of preparedness, delays, or errors in closing as the key issues impacting their experience.

Snapdocs and STRAMOR offer complimentary diagnostic assessments to help lenders understand how they rank against these industry benchmarks and create customized strategies to optimize their borrower experience. To get started , please visit here.

"As the mortgage landscape becomes more competitive, lenders need the very best insight, tools, and resources to compete and win over borrowers," said Michael Sachdev, president at Snapdocs. "This new report, coupled with our customized assessments, equip lenders to evaluate their borrower experience against industry benchmarks, understand opportunities to improve and make changes that encourage repeat business and earn customer referrals.”

Snapdocs and STRATMOR will present the full findings from “The State of Borrower Experience” in a webinar with MBA on August 31, 2022. To sign up for the session, or to receive upcoming research from Snapdocs and STRATMOR, please visit here.

About Snapdocs

Snapdocs is the mortgage industry’s leading digital closing platform. Powering millions of closings each year, Snapdocs combines an open platform, patented AI technology, the largest settlement network, and a team of industry experts to ensure digital closing success. Our proven approach enables market-leading lenders and title companies to automate the closing process and turn it into a competitive advantage. Using Snapdocs, lenders and title companies close more loans at lower costs while delivering the modern, referral-worthy digital experience borrowers expect. For more information, please visit www.snapdocs.com.

About STRATMOR Group

STRATMOR Group is a leading mortgage industry advisory firm that provides a range of programs and services designed to counsel lender CEOs and senior executives. STRATMOR serves more than 250 companies annually, providing strategies that increase growth and improve profitability in sales, marketing, technology, operations and mergers and acquisitions. The company leverages comprehensive, proprietary data and key insights gained through extensive experience in the mortgage industry. STRATMOR is well known for its financial models and its collaboration with the Mortgage Bankers Association in the PGR: MBA and STRATMOR Peer Group Roundtables Program. Find out more about STRATMOR on its website at www.stratmorgroup.com.

Media Contacts

Sara Pallas