POS INTEGRATIONS

Fast, convenient, and error-free closings from within your POS

Provide a best-in-class homebuying experience with one convenient process for all closing tasks.

Enable borrowers to easily access all closing tasks directly from your POS

Snapdocs integrates with any POS platform. Select your POS provider to learn more.

Don't see your POS? Let's chat.

Enable borrowers to easily access all closing tasks directly from your POS

Snapdocs integrates with any POS platform. Select your POS provider to learn more.

Don't see your POS? Let's chat.

Flexible options to integrate the way that works for you—either from Snapdocs or your POS

Hundreds of lenders use Snapdocs to improve the closing process. Now, lenders have the flexibility to choose how borrowers close—either within the Snapdocs platform or your POS.

Closing on the Snapdocs platform

Two-factor authentication allows borrowers to easily preview and eSign closing documents within the Snapdocs platform, without the need for additional login credentials.

Closing within your POS

Borrowers can seamlessly continue their homebuying process by previewing, eSigning, and completing all closing tasks from within your POS.

A quick and easy closing experience for your borrowers

A digital closing is user-friendly, fast, and provides the information borrowers need to feel prepared on closing day. Borrowers can complete their closing in just four simple steps:

Closing documents are digitally prepared by the lender.

When the documents are ready, the borrower(s) receive an email to review their closing package.

Borrower(s) are prompted to eSign documents remotely from their computer, tablet, or smartphone.

At the in-person closing appointment, borrower(s) sign any remaining documents that require a wet-ink signature.

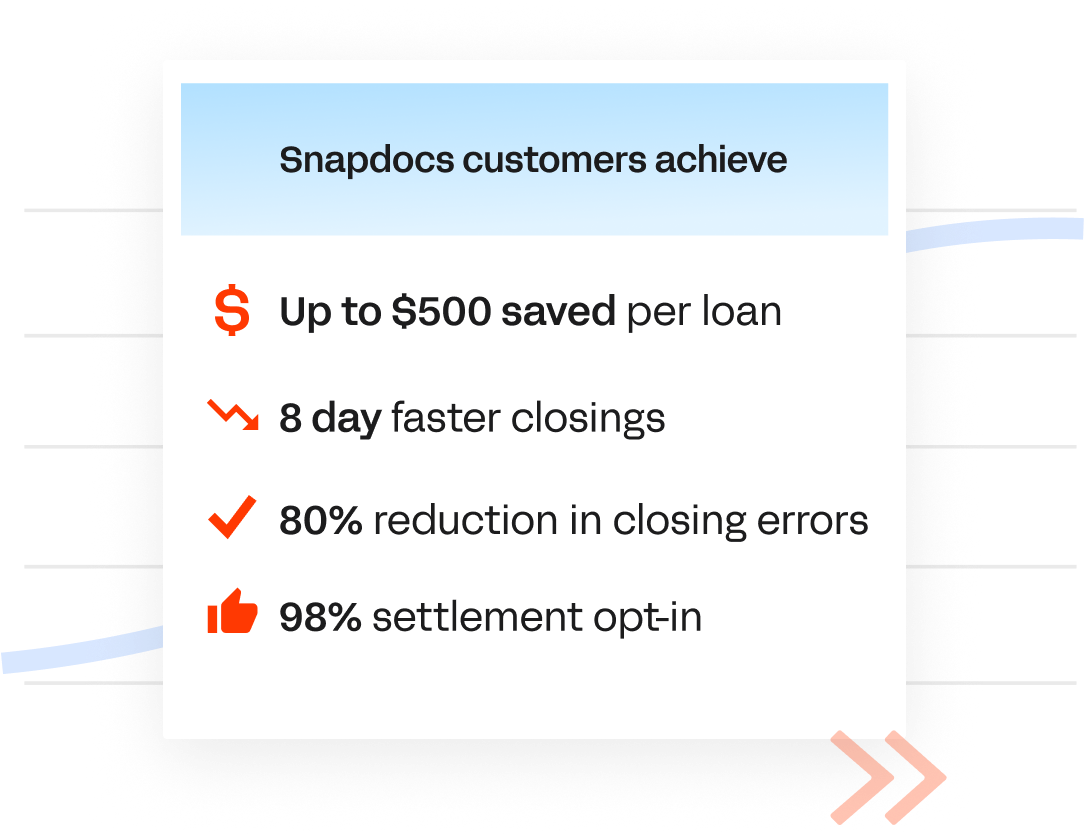

Take control of the closing process with fast, convenient, and error-free transactions

Lenders who integrate their POS with the Snapdocs digital closing solution see significant benefits in cost-savings and efficiency gains.