SAN FRANCISCO – July 24, 2023 – Snapdocs, the mortgage industry’s leading digital closing provider, has launched Connected Closings, a first-of-its-kind integration between the Snapdocs Digital Closing and Notary Scheduling platforms. With Connected Closings, Snapdocs customers reduce closing times by at least a day and a half, settlement companies return scanbacks two-times faster by eliminating manual tasks, and borrowers electronically sign documents prior to the closing appointment more than 90% of the time. Snapdocs lender and settlement customers using Connected Closings include The Federal Savings Bank and BCHH, a leading provider of real estate title and closing nationwide.

“Lender and settlement workflows have historically been completely fragmented, resulting in errors and wasted time,” Snapdocs Chairman and Founder Aaron King said. “This industry-first innovation is a win-win for both parties. Lenders feel more in control with visibility and access to the real-time information around the signing. Meanwhile, settlement can increase revenue opportunities by providing a digital experience lenders actually want to use. This results in more efficient closings and better business results for everyone. There’s nothing on the market like it.”

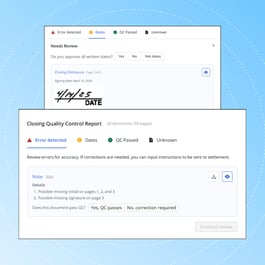

Connected Closings reduces the unnecessary, back-and-forth communication by offering seamless data exchange, automatic document sharing between all parties, and real-time updates of the signing appointment, notary search, and closing documents. By unifying Snapdocs Digital Closing and Snapdocs Notary Scheduling workflows, Connected Closings ensures a perfect signing and closing experience every time.

“At a time when real estate transaction volumes have slowed, the ability to digitally collaborate with lenders gives us a valuable edge,” said Melanie Miller, Sr. Operations Manager of BCHH. “It removes manual tasks and reduces errors, while automatically sending signing updates to ensure that the lender, our scheduler, and the notary are perfectly in-sync. It makes our jobs much easier and helps us stand out to our lenders.”

For lenders, one of the largest hurdles for digital closing adoption is driving settlement adoption of new technology and workflows. Connected Closings provides an incentive for Title companies to become more engaged in the digital closing due to its increased transparency, improved communication, and streamlined coordination.

“We’ve been using Snapdocs eClose for just under two years and the addition of Connected Closings has been a game changer by improving our communication and real-time visibility with our settlement partners and notaries,” said Desiree Kirkland, SVP of Closing Operations for The Federal Savings Bank. “The implementation of Connected Closings has also been paramount in coordinating with settlement partners, saving us time, money, and resources, while delivering the ultimate borrower experience.”

Snapdocs is hosting a webinar that will dive deeper into how lenders and settlement companies can improve their closing process with Connected Closings. Watch the webinar replay.

About Snapdocs

Snapdocs is the mortgage industry’s leading digital closing platform. Powering millions of closings each year, Snapdocs combines an open platform, patented AI technology, the largest settlement network, and a team of industry experts to ensure digital closing success. Our proven approach enables market-leading lenders and title companies to automate the closing process and turn it into a competitive advantage. Using Snapdocs, lenders and title companies close more loans at lower costs while delivering the modern, referral-worthy digital experience borrowers expect. For more information, please visit www.snapdocs.com.

Press Contact

Sam Garcia, Publicist

Strategic Vantage Marketing and Public Relations

214.762.4457 | samgarcia@strategicvantage.com

Business Contact

Laura Mighdoll

Snapdocs

press@snapdocs.com