2024 Edition

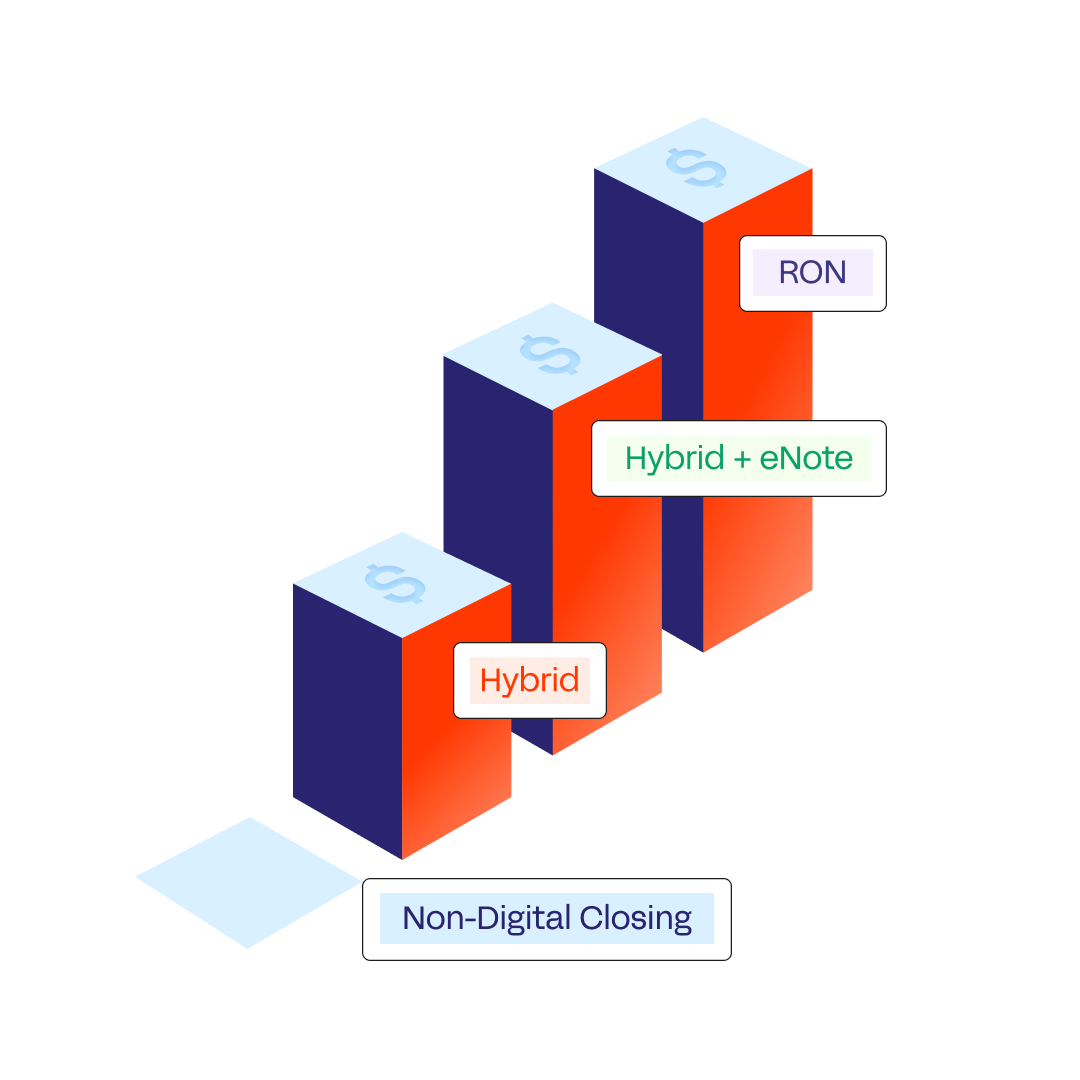

The ROI of Digital Closings

Falcon Capital Advisors recently conducted a cost-savings analysis of digital closings. Download the report to learn how to calculate the financial impact of eClosing—and the key factors that influence ROI.

Inside the guide

Aggregate savings-per-loan

Data from 25+ mortgage lenders and secondary market participants validate per-loan savings, driven by operational and secondary market efficiencies.

The 8 categories of eClosing ROI

The study outlines eight core categories that individually influence cost savings, including error reduction, warehouse line spread, and more.

Pricing gains on the secondary market

This year's report includes new insights on how digital closings drive pricing gains on the secondary market (due to faster loan delivery to investors).