EXECUTIVE ROUNDTABLE

AI in Mortgage Operations: From Market Trends to Actionable Strategies

Catch the recorded session where industry leaders shared how lenders used AI across the mortgage lending process to streamline workflows, minimize costly errors, boost efficiency, and enhance the borrower experience.

Webinar overview

AI has been reshaping mortgage operations, and lenders have been moving quickly to keep pace. More than half (55%) said they planned to pilot or roll out AI more broadly in 2025, reflecting significant investment. Yet many were still trying to define what AI really meant for mortgage lending and how to implement it in a way that delivered measurable results.

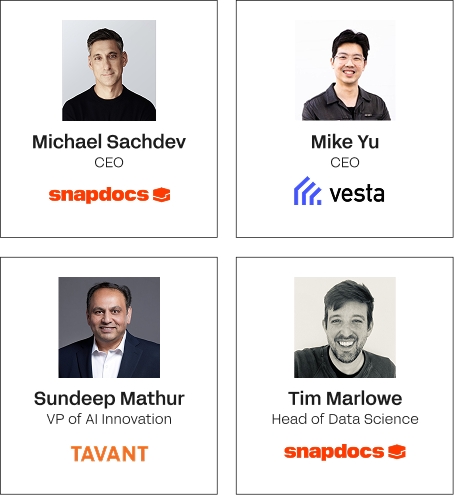

This session brought together mortgage technology executives to discuss how lenders achieved real results with AI—automating back-office processes, reducing compliance risk, and delivering faster, more seamless borrower experiences.

In this session, viewers heard about:

- Industry Insights: Where AI adoption stood in mortgage lending—and how lenders were already turning investments into real results.

- Back-Office Automation: How AI streamlined time-consuming processes by reducing manual reviews, minimizing errors, and cutting operational costs.

- Real-World Applications: How AI improved workflows such as quality control, with practical takeaways for lenders at every stage of the mortgage process.

Don’t miss the opportunity to watch the recording and see how AI transformed mortgage operations—and how your team can start capturing the benefits today.

1 Fannie Mae: Mortgage Lenders Cite Operational Efficiency as Primary Motivation for AI Adoption