SNAPDOCS & THE MORTGAGE COLLABORATIVE

Digital closings that meet your expectations

Snapdocs is a preferred partner of The Mortgage Collaborative. Our best-in-class technology and strategic partnership guide you through every step of your digital closing journey, enabling eClosing adoption at scale.

We invite you to learn more about exclusive pricing available to your company as a TMC member.

How TMC member, Allied Mortgage, implemented eClosings with little disruption

When Allied Mortgage was looking for an eClosing provider, they needed a partner who would implement eClosings quickly, with little disruption to their current workflow. This meant partnering with a provider who has the ability to integrate with any document preparation provider, and an advanced understanding of the mortgage industry. Snapdocs has given Allied Mortgage a seamless experience for all parties involved in the closing process–using automation to increase accuracy and decrease manual processes.

We know time is money

That’s why we partner with you through the journey to ensure you get it right the first time. Snapdocs provides a secure technical roadmap and conducts implementation, provides training & change management, and partners hand-in-hand through rollout. It’s why lenders typically implement within their first weeks on the platform and scale to full adoption within their first year.

“Since working with Snapdocs, we've seen massive operational efficiency gains. I highly recommend Snapdocs to any lender looking to get ahead of the market, scale your digital closings, and improve the borrower experience.”Jake Rowoldt, VP Information Services

“There are a number of eClosing providers to choose from. The key is finding the provider who shares your success story, and who partners with you to reach a common goal...Snapdocs is a win-win. It’s a win for customer experience and it’s a win for efficiency.”Jeff Henkel, SVP Closing Fulfillment

Dramatically increase your closing team’s efficiency

One efficient process for every closing

Streamline every closing with every settlement partner.

Automate & digitize slow manual processes

Eliminate low-value tasks so your team can focus on revenue-generating activities.

Accelerate the closing process

Allow borrowers to preview the whole closing package and eSign most documents before the closing appointment.

AI-powered document processing

Artificial Intelligence automatically prepares documents for eSignature, so you don’t have to.

The Snapdocs standard

AI-Powered technology

Whether you transition to hybrid, eNote, or fully digital closings, Snapdocs provides a single, standardized process for every loan.

Connected experience

Snapdocs links lending and settlement teams across the mortgage closing process to enable the best experience possible for borrowers.

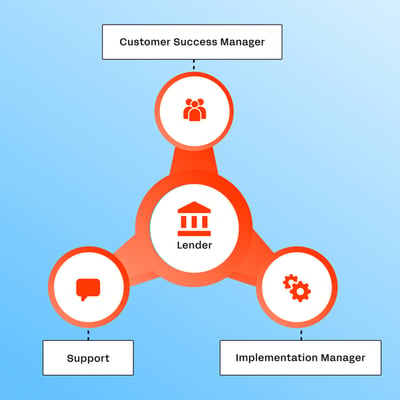

Award-winning customer service

Work with a team that supports your implementation, and has a proven track record of increasing digital closing adoption—for meaningful business impact.

Read the ReviewsSeamless integrations & APIs

Our solutions seamlessly integrate with your existing LOS, POS, and eVault solutions, so you can choose the providers that work best for your business.

Explore Integrations