Snapdocs eClosing ROI Calculator

Calculate how much your company can save with the Snapdocs eClosing solution.

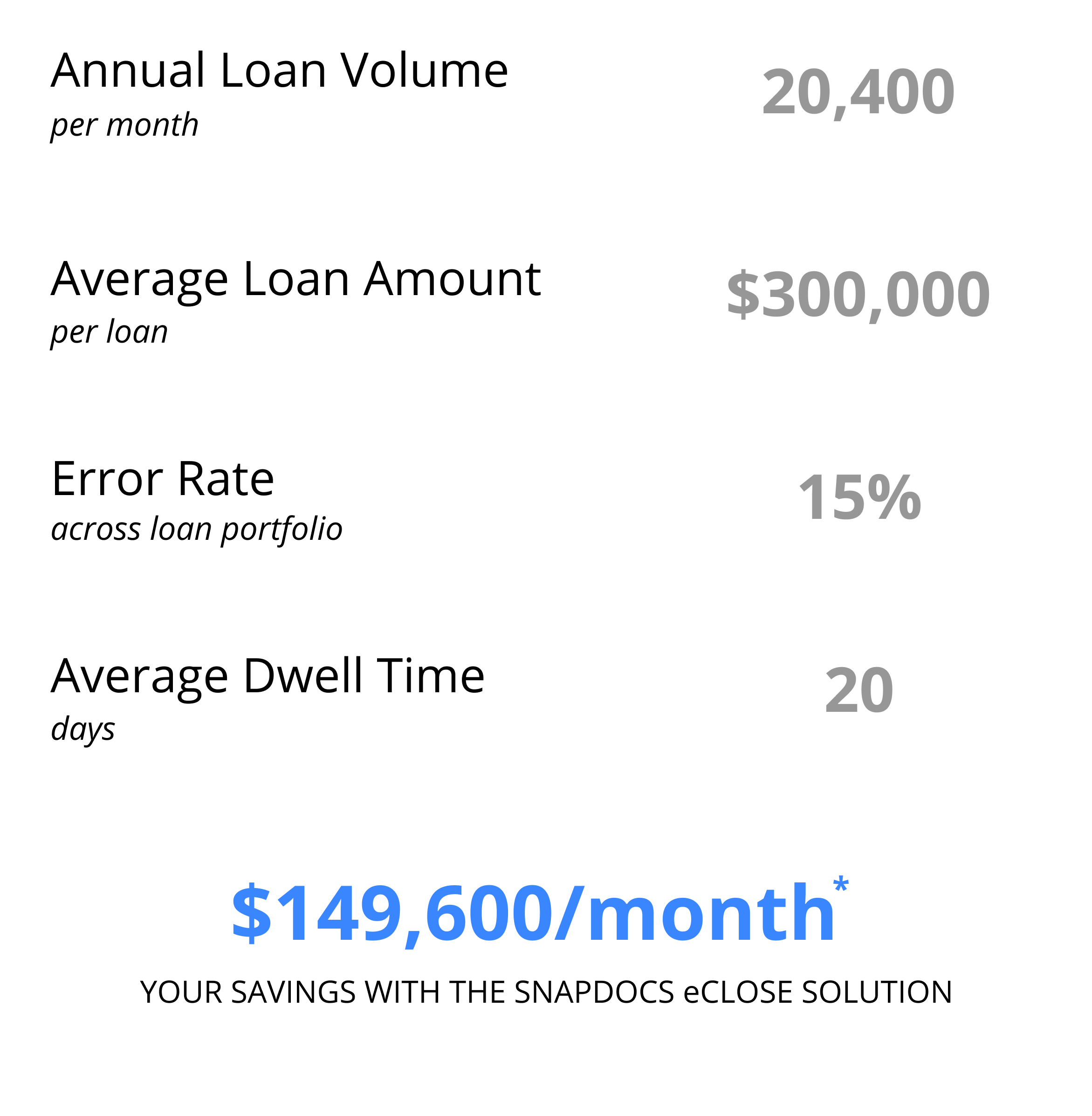

Your Business Inputs

Example ROI Summary

*This cost-savings calculation is an example from a real Snapdocs lender. Your estimated cost-savings will be dependent on the business inputs you have provided.

Stuck on a question or unsure of an exact figure? Reach out and an eClosing specialist can provide assistance with your ROI calculation.

How the ROI calculation works

Provide your business inputs

Answer a few short questions about your organization (this takes less than 5 minutes).

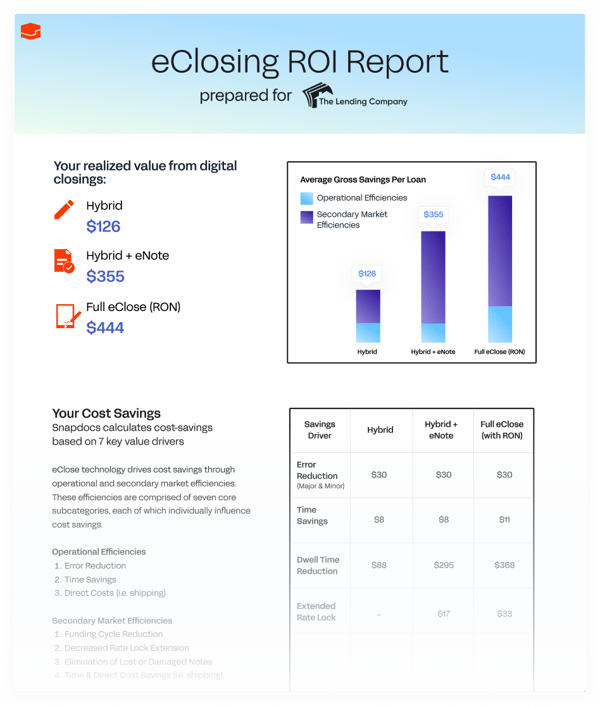

Snapdocs calculates your cost-savings

The impact of digital closings differs for every lender. The details you provide help us accurately calculate your cost savings.

Receive your ROI report

Your ROI calculation will be delivered via email. If our team has questions on the information you've provided, they will reach out to you to clarify.

“We are trying to adjust for dramatic margin compression and are focused on finding opportunities to improve our profits. Snapdocs has already helped us shave hundreds of dollars off each loan, while shortening the closing cycle and delivering a better customer experience.”Jen Bailey, Closing Department Manager

LENDER'S GUIDE

The ROI of Digital Closings

To learn about how eClosing ROI is calculated, read our latest Lender's Guide.