ARCHIVE

2022 eClosing Product Release Notes

January, 2022 Product Launch

Encompass Integration

Lenders can implement a secure and scalable process for creating and managing closings within Encompass using Snapdocs Encompass integration.

Feature benefits:

- Automatically create closings within Encompass

- Supports all types of closings

- Sends completed closing packages back into Encompass after signing

- Track closing status inside your LOS

- Automatically determine Remote Online Notarization (RON) Eligibility within Encompass

- Receive real time notifications when any documents are completed and the option to get them into Encompass

- Automatically sorts signed documents into the correct eFolder in Encompass

Settlement task-based closing experience

As a settlement agent, it can be challenging to remember how to facilitate closings on different digital closing providers and what tasks are outstanding on a given closing. It’s also a challenge to keep track of all the other technologies you have to interact with daily and the unique workflows required to be successful in your job. We want to help make this easier for you.

By simplifying the settlement experience in closings around tasks-to-complete, eliminating non-essential information, and emphasizing key actions, we will help you and your team quickly and efficiently onboard with the tasks.

For more training materials for the new settlement task- based closing experience, please reach out to your Snapdocs Customer Success Manager.

Automated eSign SMS reminders

Note: This feature requires a signed amendment from the lender prior to enabling.

Lenders can automate the process of manually sending eSign reminders to consumers who have not yet eSigned before their signing appointment using the “Automated eSign SMS reminders” feature.

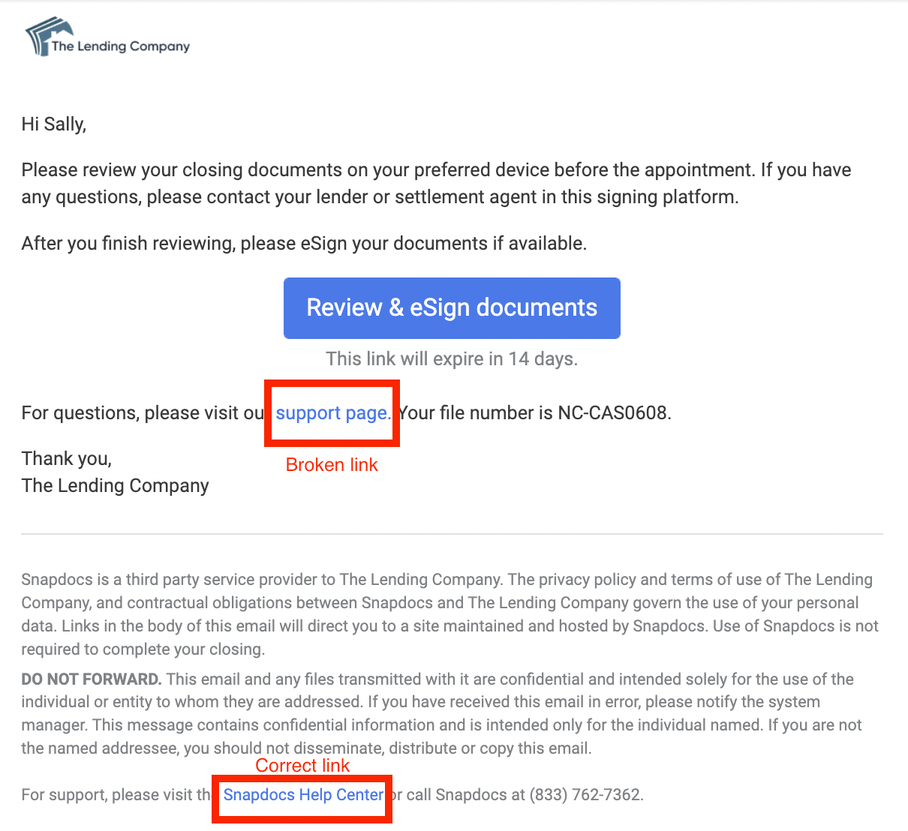

When enabled, Snapdocs will send an automated SMS reminder at 5:00 PM (local time) the day before the closing and again at 8:00 AM the day of the closing. The SMS reminder will direct consumers to their email, where they will be able to navigate to Snapdocs to eSign their documents, as shown in the following screenshot:

When an automated eSign SMS reminder is triggered, the Activity log will also record this event:

The reminder will not be sent out if:

- No appointment date has been set; and

- eSign is not yet unlocked for consumers

For more information on the new Automated eSign SMS reminders, please reach out to your Snapdocs Customer Success Manager.

January 11, 2022 Product Updates

Enhancements

Updated the redrawn package’s label in the notary UI

When a redraw occurs in closing with an assigned notary, the redrawn package will have a “redrawn” label to help point the notary to the correct package.

Display a watermarked eNote package in the “Download unsigned documents” section

The lender will be able to download the unsigned watermarked eNote package separately.

Bug Fix

We fixed the issue in which the lender selected to send messages to the settlement office only, but the Audit trail indicated that the messages were also sent to the consumer.The fix ensures the Audit trail displays the correct recipients receiving the messages.

February 02, 2022 Product Updates

Enhancements

Closing API- Fixed “Docs_Ready_For_Preview/Signing” webhook duplications

We have made some improvements to eliminate the webhook duplications, as detailed below:

- When the “Documents are available to preview” email setting is turned on for consumers, trigger the

DOCS_SENT_TO_CONSUMER_FOR_PREVIEWwebhook. - When the “Documents are available to eSign” email setting is turned on for consumers, trigger the

DOCS_SENT_TO_CONSUMER_FOR_SIGNINGwebhook. - When the “Documents are available to preview” email setting is turned off for consumers, trigger the

DOCS_READY_FOR_PREVIEWwebhook. - When the “Documents are available to eSign” email setting is turned off for consumers, trigger the

DOCS_READY_FOR_SIGNINGwebhook.

Encompass Integration - Improved the “eSigning has been completed” email content for settlement

Suppose a lender has the setting enabled to have eSigned docs returned to Encompass as soon as eSigning is completed. When the consumer completes eSigning, the settlement agent will receive the following email:

Full eClosing - Added the “Complete signing” event to the Activity log

When the “ron_signed_combined_documents” event is marked as complete, the system will create the “Complete signing” event in the Activity log, as shown in the following screenshot:

Bug Fix

We fixed the issue with the “Export Closing” feature timed out if the export load took more than four minutes.The fix is to apply a different filtering method to ensure the export load will complete in less than four minutes.

February 15, 2022 Product Updates

Enhancements

Added watermark to signed eNote

We’ve added watermarks to the signed eNote, since this document is not the official signed eNote stored in the eVault.

Send RON reminders when closing created on the same day as the appointment

Both the consumer and notary will receive a reminder 30 minutes before the appointment.

Allow users with the “View & Comment” role to send eSign reminders from the closing UI

Besides viewing and commenting on closings that they are added to, this role can now send eSign reminders to the consumer.

Updated the “You have a new closing” to match the settlement task-based navigation

Below is the updated email:

Allow settlement agents to configure their preferred time zone

To configure their preferred time zone, click My account, then select the preferred time zone.

Updated instructional texts in the “Set Signing Appointment” section

When no notary has been assigned to the closing, the texts will be: “Please request a notary.”

When a notary has been assigned to the closing, no instructional texts will display:

Display logics of the “Finish adding” button

Settlement agents will not see this button on the UI until they have uploaded a scanback. The intention is to avoid confusion to the lender because an email notification was triggered stating the settlement agents had uploaded scanbacks although they hadn't uploaded any documents.

Bug Fixes

We fixed the following issues:

- A consumer was receiving 2FA codes via email instead of a text/call.

We’ve identified the issue and fixed it. - Some eSigned documents were not pushed back to Snapdocs.

We have added more logging parameters to help identify the root cause of this issue. - Many settlement agents appeared to upload several duplicates of the signed documents. These agents were both using IE 11 to access Snapdocs closings.

We fixed this issue!

March 2022, Product Launch

Encompass Integration - Document redraw

Encompass lender users can easily request a document redraw (partial or full), as well as updating closing information without leaving their LOS.

Feature benefits:

- Minimize the time it takes closers to order a redraw (only order redrawn documents).

- Ensure the settlement agent (or notary) gets the new redrawn documents.

- The settlement agent (or notary) only needs to print the redrawn documents.

- Individual redrawn documents are logged in Disclosure Tracking.

- If the consumer has not completed eSigning, their eSign package is updated with the redrawn documents.

- If the consumer has already eSigned, Snapdocs will notify them of the document change via email, and allow them to review the replaced documents.

Snapdocs Connect

Snapdocs Connect is a set of public APIs for lenders to integrate their LOS with Snapdocs. It provides a scalable and secure process for creating, tracking, updating transactions, and receiving signed closing documents in Snapdocs. Snapdocs Connect brings massive efficiency gains that result in faster closings and lower costs without the need to leave the LOS environment.

How does the feature work?

Snapdocs provides a set of public APIs to enable lenders to take the following actions directly from their LOS:

- Authenticate

- Create a closing

- Send closing documents to Snapdocs

- Get a list of documents on the closing

- Download documents from the closing

- Complete and close the closing

- Cancel the closing

- Reopen the closing

- Utilize webhooks to receive updates about:

- Closing document status

- Document redraw status

- Preview status

- eSign status

- Notary status

- Closing status

Please reach out to your Snapdocs Customer Success Manager for more information about Snapdocs Connect, or visit Snapdocs API Documentation.

March 01, 2022 Product Updates

Enhancements

Relock eSign after the appointment date is moved to the future

When the eSign feature policy is set to be on the day of the wet signing, if the lender or settlement agent updates the appointment to be on a future day, the system will relock eSign.

Snapdocs Connect - Updated preview & eSign statuses

When a user calls the GET /api/v1/closings/{closing_uuid}/borrowers endpoint, the following scenarios and their respective statuses will return:

| Scenario | Preview status | eSign status |

| No documents added yet | Not ready | Not ready |

| Documents processing | Not ready | Not ready |

| Documents done processing | Ready | Ready |

| Convert to wet sign & Doc Process is in progress | Not ready | Not applicable |

| Convert to wet sign & Doc Process is complete | Ready | Not applicable |

| Convert back to hybrid & Doc Process is in progress | Not ready | Not ready |

| Convert back to hybrid & Doc Process is complete | Ready | Ready |

| Documents previewed | Completed | Ready |

| Documents eSigned | Completed | Completed |

Bug Fix

We fixed the issue when exporting a filtered closing dashboard, if there were closings where a mobile notary had not been requested, the exported file would be blank.

March 15, 2022 Product Updates

Enhancements

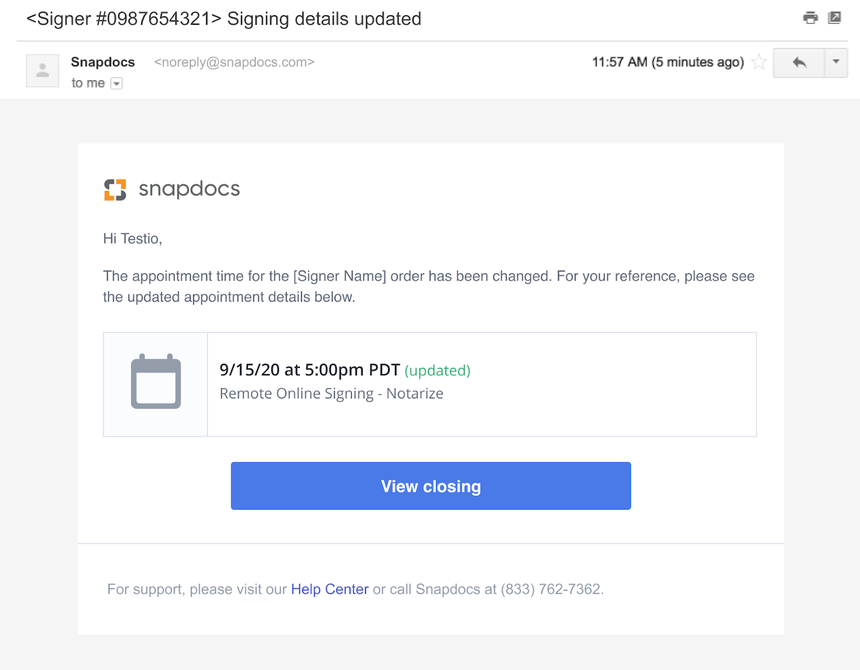

Notify the POS when appointment details changed

Snapdocs will notify the POS when any appointment details have been changed so that the consumer can be alerted from the POS directly.

Notify the POS when a closing conversion happens

When a closing is converted from a wet to hybrid, or from a hybrid (with or without eNote) to wet, Snapdocs will notify the POS so that they can trigger the appropriate workflow for the consumer.

Notify the POS when an eSign reminder is triggered

Snapdocs will notify the POS when a manual/automatic eSign reminder has been triggered.

April 2022, Product Launch

MISMO e-Eligibility Exchange

Snapdocs is launching the MISMO e-Eligibility Exchange, a searchable repository of e-Eligibility standards, requirements and capabilities for companies that participate in various aspects of a mortgage closing. Users will also be able to search any legal barriers to digital closings by State and County. The results from the exchange will be a snapshot of the digital standards for all selected companies and locations.

Below is a sample search of e-Eligibility allowed by the State of Wisconsin:

Please reach out to your Snapdocs Customer Success Manager for more details.

Snapdocs Connect - New endpoint for closing status

To get the status of a closing, call the /closings/{closing uuid}/status endpoint.

To specify which closing, use the closing UUID. Reference Get closing status for details.

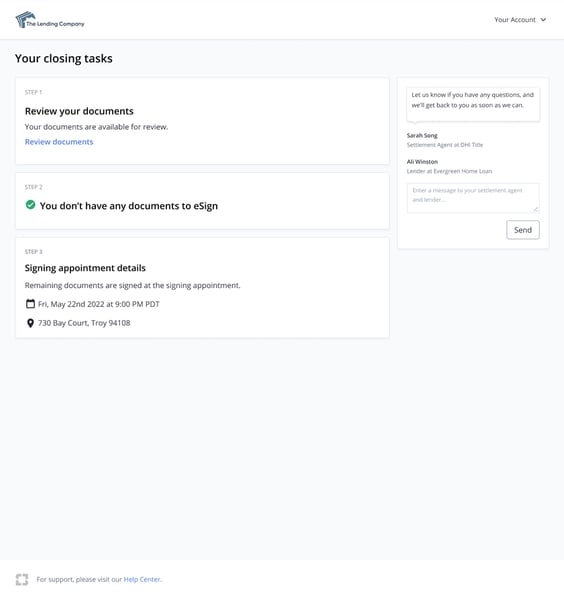

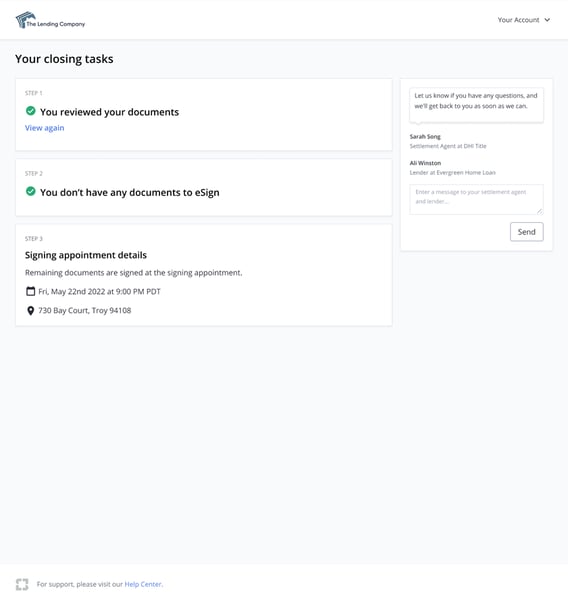

Non-eSigning Consumers

This feature allows consumers to exist on a closing (without error) even if they have nothing to eSign. The consumers will have the ability to preview all documents and place comments on the closing, but will not have an eSign step.

Lender’s view

The closing UI when there is a non-eSigning consumer will look like the following:

Settlement’s view

Below is how it looks like on the settlement’s task-based view:

Non-eSigning consumer’s view

After Doc Process has been completed, the system will notify the non-eSigning consumer to review the documents. Below is the email sent to them:

Below is the non-eSigning consumer’s view:

eSigning consumer’s view

Below is the eSign consumer’s view:

Please reach out to your Snapdocs Customer Success Manager for more details about this feature.

April 05, 2022 Product Updates

Enhancements

Loan Purpose and Loan Type

When creating a closing using the EMI or the Parser, lenders can include both loan_purpose and loan_type fields.

Snapdocs will use these fields to build the ability for lender users to filter their dashboards by loan purpose or loan type, and introduce it soon.

Full eClosing - Display new signing statuses in the UI

Below are the new signing statuses:

- In Progress - When the signing is in progress.

- Complete - When the singing is either complete or pending.

- Not Scheduled - When the appointment date and time is not yet set, and the signing status is not either “In Progress” or “Complete”.

- Scheduled - When the appointment date and time is set, and the signing status is not either “In Progress” or “Complete”.

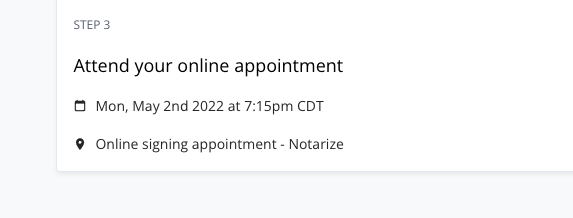

Full eClosing - Updated the Consumer Journey

We've updated the Consumer Journey to include the RON provider name in the "Completed Signing appointment" step.

POS - Changed the endpoint for requesting eSigning opt-out/opt-in

When consumers want to opt out of eSigning from the POS, use the /closings/{uuid}/esigning/opt_out endpoint.

When consumers want to opt back into eSigning from the POS, use the /closings/{uuid}/esigning/opt_in endpoint.

POS- Notify the POS about notary order’s statuses

Snapdocs will notify the POS when any of the following events occur:

- Mobile notary order created

- Mobile notary order canceled

- Mobile notary assigned

- Mobile notary appointment confirmed

- Mobile notary order completed

- Mobile notary order did not sign

- Mobile notary assigned

Updated the “Review and eSign” email when the closing has non-eSigning consumers

The updated email will contain the following information: “Please review your closing documents on your preferred device. After you finish reviewing, please eSign your documents if available. All signers will need to eSign these documents separately. Each co-signer, and any other document viewers, will receive this email.”

Updated the logic triggering the “Documents updated” email

The system will only send the “Documents updated” email to the consumer when the redraw is either eSign, preview, or eNote.

Bug Fix

We fixed the issue where the system did not display the alert banner on several closings where consumers did not have a phone number.

April 19, 2022 Product Updates

Enhancements

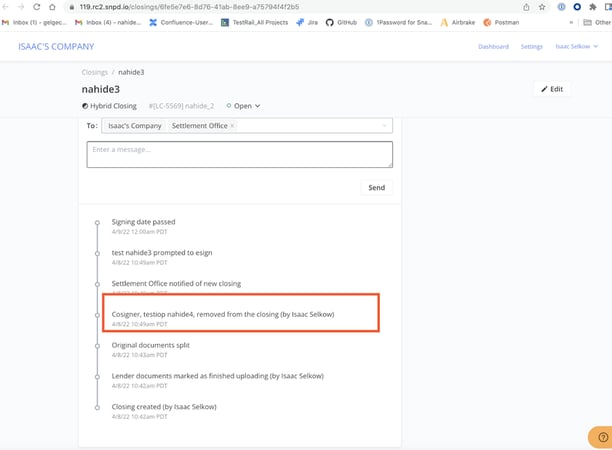

Added the logic for removing non-eSigning consumer

The system will remove all non-eSigning consumers from a closing when:

- The feature is set to “Remove non-eSigning consumers from closing”; or

- When the closing is a dual borrower closing.

The system will record the action of removing a non-eSigning consumer from the closing in the Activity log:

Updated the non-eSigning consumer’s UI

We’ve updated the non-eSiging consumer’s UI as shown below:

Before the consumer review documents:

Allow consumers to eSign when a canceled closing is reopen

After the lender has reopened a canceled closing, all consumers will be able to eSign the documents.

Added POS’s URL to the “Return to Dashboard” button

For POS integration, after completing the eSigning, if the consumer clicks Return to Dashboard, the system will redirect them to the POS’s URL.

Updated the “Closing package has been updated” email sent to the settlement agent

We’ve updated the email’s verbiage to let the settlement agent know what action is expected from them. Below is the updated email:

Updated the lender’s and settlement’s UI when a document redraw occurs

| Trigger | Lender’s UI | Settlement’s UI |

| When the settlement agent has not yet downloaded the updated documents |

|

|

| When the settlement agent has downloaded the updated documents |

|

|

Full eClosing - Display the start and end of the RON signing in the Consumer Journey

| When the signing appointment status is complete, the system will show the status along with the timestamp |  |

| When the signing appointment status is in progress, the system will show the started time |  |

Full eClosing - Allow settlement agents to download the lender scanbacks

Settlement agents will be able to download lender scanbacks from Snapdocs, but will not be able to delete them.

Added the ability to view collated unclassified pages in the document viewer

Escrow officers can quickly identify which pages are unclassified so that they can fix the package and get it sent to the lender as soon as possible.

To do so, from the Closing Quality Control Report, click Unclassified pages, then choose View.

Bug Fixes

We fixed the following issues:

- Consumers who have an active notary account with Snapdocs were not able to access their closing.

- A consumer on a full eClosing with eNote was not able to eSign after the lender updated the appointment date.

- When exporting a filtered closing dashboard, the closings included in the export file were different from the filtered closings shown on the screen.

- Lender users were not able to send messages from the closing.

May 2022, Product Launch

Small Enhancements This Month

Visit our Help Center to see everything that’s new in Snapdocs for this month.

May 03, 2022 Product Updates

New

Replaced Zendesk widget with Ada chatbot

Snapdocs is rolling out an upgraded AI-Assisted Chatbot, Ada, which serves as a ticket-generating tool when the bot can’t assist the customer. Ada will help enabling our interaction with Snapdocs' users to be continuously available, completely consistent, and always helpful.

Enhancements

Display an indicator for POS-generated closings

We’re adding the POS <partnername> indicator to the closing UI to indicate it’s generated from a POS. Note that the system will include the POS number as part of the in the “closing created” event in the Activity Log.

Refer to the below screenshot for the indicator’s location:

SSO solution for one POS and direct closings

Until we officially launch the support for lenders with multiple POS, Snapdocs is introducing an interim solution, in which:

- POS consumers will get notified from the POS system and log into Snapdocs to review and eSign documents using their POS credentials (if the lender has SSO enabled.)

- Direct closing consumers will get notified from Snapdocs and log into Snapdocs to review and eSign documents via a secure access link, even if the lender has SSO enabled.

Created logic to switch between consumer login preferences

A lender can now have multiple consumer login preferences (a default one and one/every POS that the lender uses).Use the following logic to determine which login preference is applied to the consumer in a closing:

- For non-POS closings, use the default consumer login preference.

- For POS-generated closings, use the lender login preference.

Allow settlement agents to download the lender’s scanbacks

Settlement agents will be able to download lender’s scanbacks from Snapdocs, but will not be able to delete them.

Added POS’s URL to both the “Finish review” & Back button

For POS integration, after completing reviewing documents (while eSigning is still blocked), when the consumer clicks Finish review, the system will redirect them to the POS’s URL.

At any point in the Consumer Experience, if the consumer clicks the Back button (located in the upper left corner of the preview screen), the system will redirect them to the POS’s URL.

Added Loan Purpose and Loan Type columns to the dashboard

Using these new columns, lender users and settlement agents can display and sort closings.

Added Loan Purpose and Loan Type fields to the closing create form

Lenders can provide loan purpose and loan type information when creating closings in Snapdocs UI:

Possible values for loan purpose are:

Possible values for loan type are:

Added Loan Purpose and Loan Type data to the closing UI

The system will populate loan purpose and loan type’s data on the same row with closing type and closing status. Note that the lender will not be able to edit loan purpose and loan type's data when in Edit mode.

Full eClosing - Updated the activity log

We’ve updated the activity log for full eClosings as detailed below:

- Changed "Wet signing marked as complete" to "Full eClosing marked as complete."

- Changed "[Name] created a mobile notary order" to "[Name] created a RON notary order."

- Only log one "signed_ron_documents" event when the combined RON package is uploaded.

- Use the "RON notary order" verbiage when mentioning the notary order.

Full eClosing - Updated the “Appointment reminder” email sent to the consumer

In the updated email, we include instructions for the borrower to begin the login process 15 min before the signing appointment to account and swap the location of the Notarize Support and Title Agent contact info.

Below is the updated email:

Full eClosing - Notify the lender and lender contacts when the appointment date/time is updated in Notarize for Collab workflow

Below is the sample email:

Bug Fix

We fixed the issue in which a consumer was able to eSign the eNote a few days before the signing appointment. This issue happened to closings in which the consumers share the same email address, and the lender had the Multiple eSign functionality enabled.

May 17, 2022 Product Updates

Enhancements

Allow Closing Quality Control to return multiple errors

When multiple errors are found, the system will display a user-friendly error message for each error on the Closing Quality Control report:

Removed the "QC Passed" indicator from the closing UI

Display specific event log for POS-generated closing

The system will record the closing created event for POS-generated closings as: Closing created via [insert POS name] (by Snapdocs Assistant)

Added email setting support for lenders with multiple POS integrations

In the lender’s email setting, we added a consumer checkbox to allow lenders to select which POS to use in communication with the consumers.

When the POS is unchecked:

- Snapdocs will send email communications to the consumers for non-POS closings.

- The POS will send email communications to the consumers for POS-generated closings.

- When the POS is checked:

- Snapdocs will send email communications to the consumers for both non-POS and POS-generated closings.

Below is an example:

Added a new endpoint for getting appointment details

To get a closing’s appointment details, send a GET request to the following endpoint: /closings/{closing_uuid/appointment

Bug Fix

We fixed the issue in which Admin & Manager lender users could not open reference documents unless they were added to the closing.

May 31, 2022 Product Updates

Enhancements

Edit loan type and loan purpose on closing UI

A lender can edit the Loan Type and Loan Purpose field from the Edit closing form.

Full eClosing - Updated the service-level agreement (SLA) for Document Process Restart

When a lender updates a full eClosing’s info that would trigger a document process to be restarted, the system will display the SLA time as three hours.

Full eClosing - Added RON provider info to the consumer’s UI

Below is an example:

Bug Fix

We fixed the issue in which the dashboard error page displayed the incorrect support email. The correct support email is Support@snapdocs.com.

June 2022, Product Launch

Automatically validate that any package submitted to Snapdocs is attached to the correct closing

With this update, Snapdocs will scan all closing packages for file numbers and signer names to ensure that the information from the closing package matches the information on the closing. If the package appears to be attached to the wrong closing, we’ll notify you.

How to get started

This will be the default behavior for Snapdocs going forward; there’s no action required on your part.

Customer Advocacy Program

Joining our Customer Advocacy Program offers lenders like you the opportunity to get more involved in the decisions we make here at Snapdocs. Advocacy at Snapdocs can be as simple as leaving us a 5-star review on the ICE Marketplace or G2! If you are interested in this program, please contact emma.miller-crimm@snapdocs.com

June 14, 2022 Product Updates

Enhancements

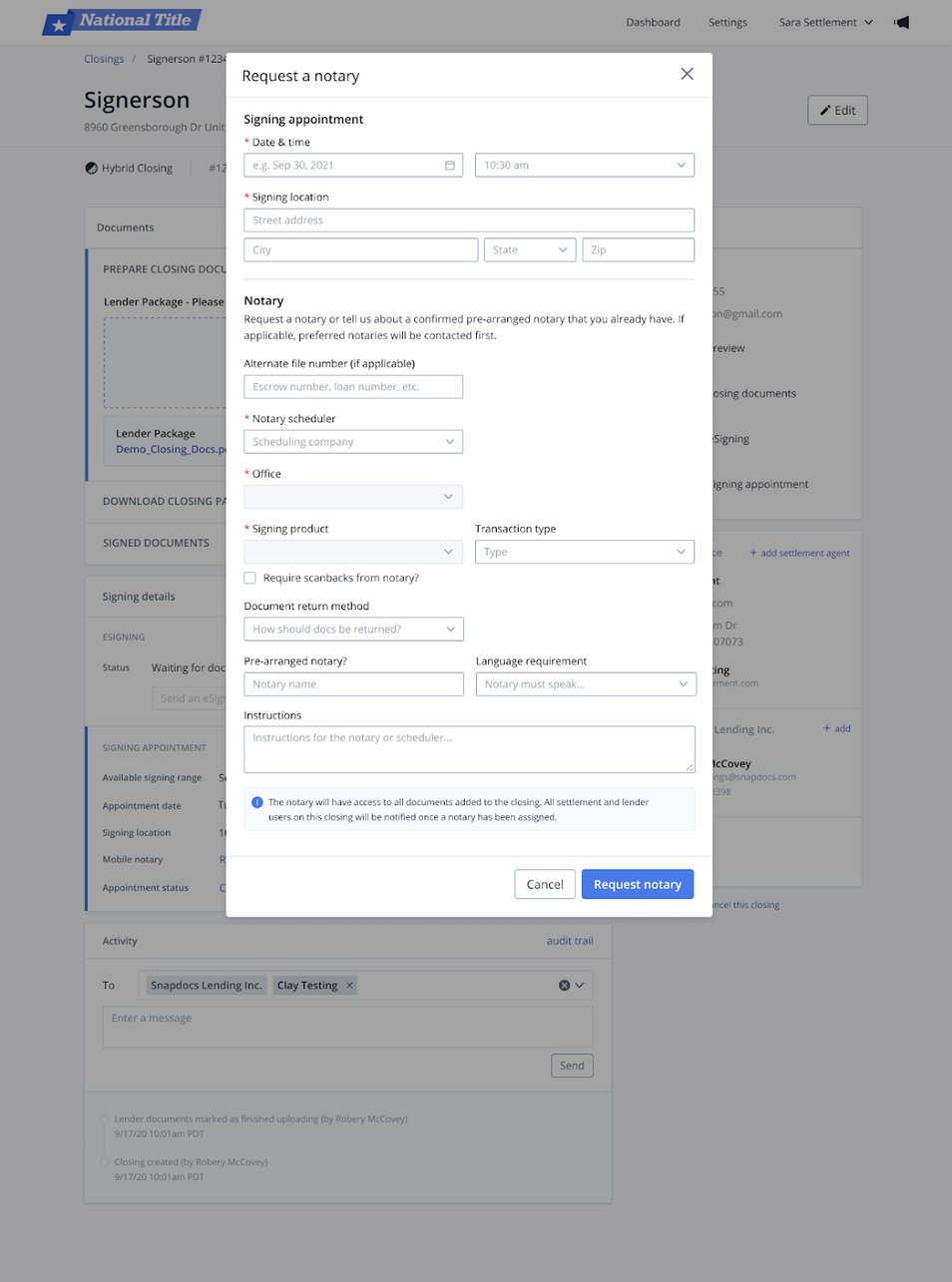

Updated the “Language requirement” field to include all Chinese variants

When creating a notary request, one can specify if the required language is either Chinese - Cantonese or Chinese - Mandarin.

Full eClosing - Redirect settlement agents to Notarize to complete tasks

If the full eClosing uses Notarize collab workflow, we will redirect settlement agents to Notarize to complete the following tasks:

- Update appointment’s date and time.

- Upload title or rush documents.

- Assign a RON notary.

Hide Ada chatbot from the Document Preview UI

We removed the Ada chatbot from the Document Preview UI to avoid overlaying the "Finish review" button.

Bug Fixes

We fixed the following issues:

- Users received duplicate “eSigning complete, signed documents available” emails.

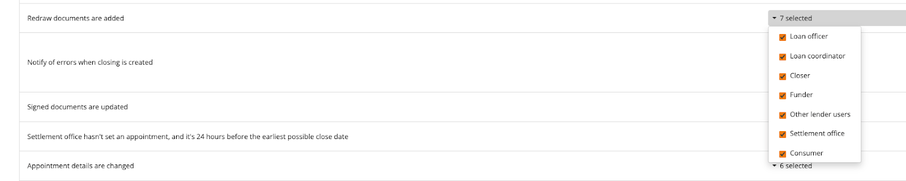

We refined the trigger logic for this email to ensure the issue is fully resolved. - When document redraws occurred, multiple closers received the “original closing package is updated” emails. To fix the issue, we mapped all the redraw emails to email settings for consumer, lender, and settlement offices to the “Redraw documents are added” email setting.

July 2022, Product Launch

Create Additional eSign Packages for Borrowers

This optional enhancement to our Redraw workflow allows you to create additional eSign packages for your borrowers (with updated or new documents) if your borrowers have already signed the first eSign package created, maximizing the percentage of documents that can be eSigned.

How to get started

Reach out to your Snapdocs Customer Success Manager for more details about the feature and the process of enabling it. This feature is available for all lenders

Now Available for Early Access

Snapdocs provides early product access to a select group of mortgage lenders. Participating lenders can try upcoming features and provide feedback while the functionality is still in development. The following is now available:

Lender Integrations: Byte Integration

Snapdocs integration with Byte will enable Lenders using Byte as their LOS to power their closings with Snapdocs. With this integration, Lenders will be able to create a closing, send data & documents, return signed documents, receive closing status updates and perform full redraws all within Byte.

How to get started

If you are interested in learning more about the integration, please reach out to your Customer Success Manager.

Click here to request access to this feature.

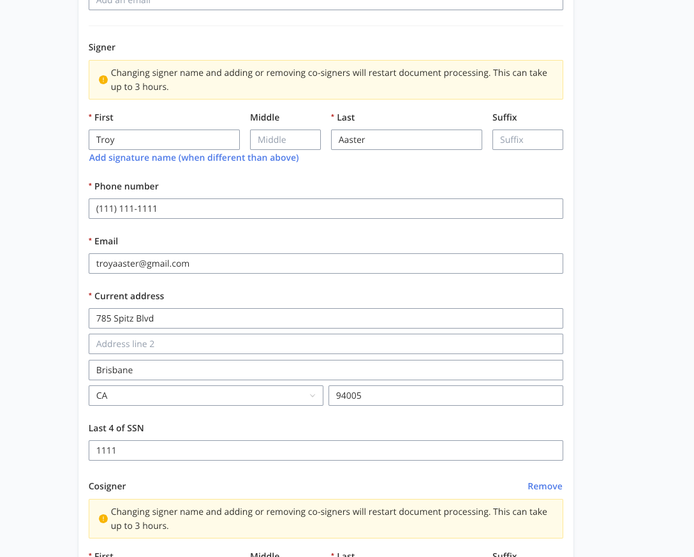

Custom Signature Name, Trust & POA Support

Closing creators can specify the borrower’s preferred signature name during the closing creation process. If provided, Snapdocs will use this signature name to annotate the eSign documents. This feature can support Trusts, POAs, or any situation where a borrower is signing by any non-standard name on a Hybrid closing.

How to get started

Reach out to your Snapdocs Customer Success Manager for more details about the feature. This feature is available for all lenders.

Click here to request access to this feature.

Loan Officers eSigning Closing Documents

With this update we will support the LO’s ability to eSign key closing documents within the Snapdocs platform. By simply sending us the LO’s name & email during closing creation, we give the LO access to eSign the same package as the borrower. This allows us to deliver back to you a fully executed closing package and save your operations team valuable time in chasing down these signatures.

How to get started

Reach out to your Snapdocs Customer Success Manager for more details about the feature. All lenders who use Ellie Docs are eligible for Early Access.

Click here to request access to this feature

eVault

Snapdocs has designed a purpose-built eVault with hyper-reliability, ease of use, automation, and interoperability as core tenets to solve the common pain points that many lenders and investors have been facing. Our eVault is expected to launch in October 2022. To prepare for our launch, Snapdocs is looking for customers to participate in Early Access to implement and scale eNote using the new Snapdocs eVault.

How to get started

If you are interested in partnering with us as an eVault Early Access customer, reach out to your Snapdocs Customer Success Manager. All lenders are eligible for Early Access.

Click here to request access to this feature.

July 05, 2022 Product Updates

Enhancements

New endpoint for updating the signing appointment

Lenders can send a request to the PUT /closings/{closing_uuid}/appointment endpoint to update a signing appointment's details of a closing.

Full eClosing - Add multiple settlement agents to Notarize orders

When a full eClosing has multiple settlement agents, the system will add them all to the associated Notarize order.

Full eClosing - Add loan officers to Notarize orders

When a full eClosing has a loan officer, the system will add them to the associated Notarize order.

Accelerated hybrid closing - Skip the acceleration on dual borrower closings

All dual borrower closings will be processed as non-accelerated closings.

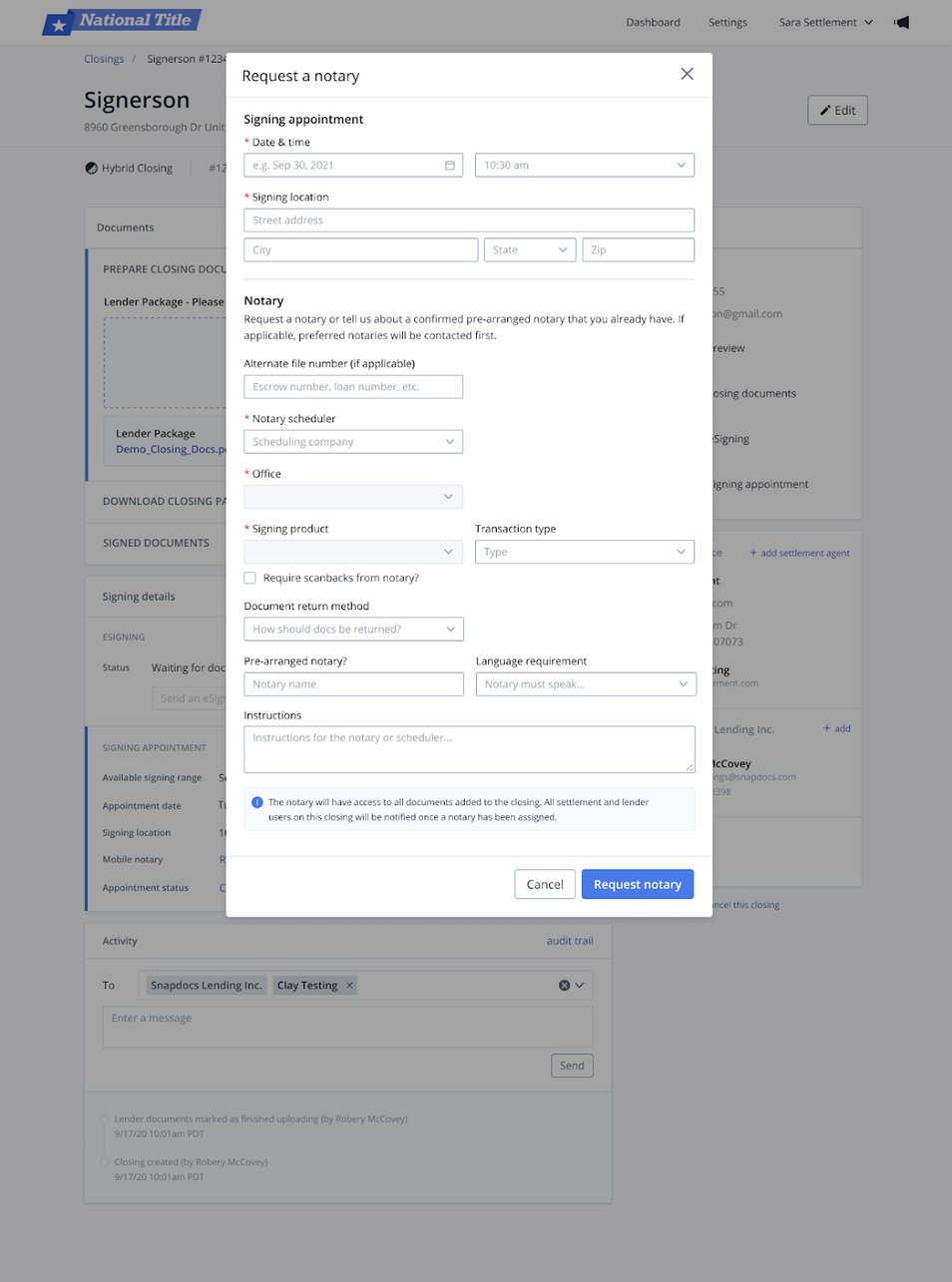

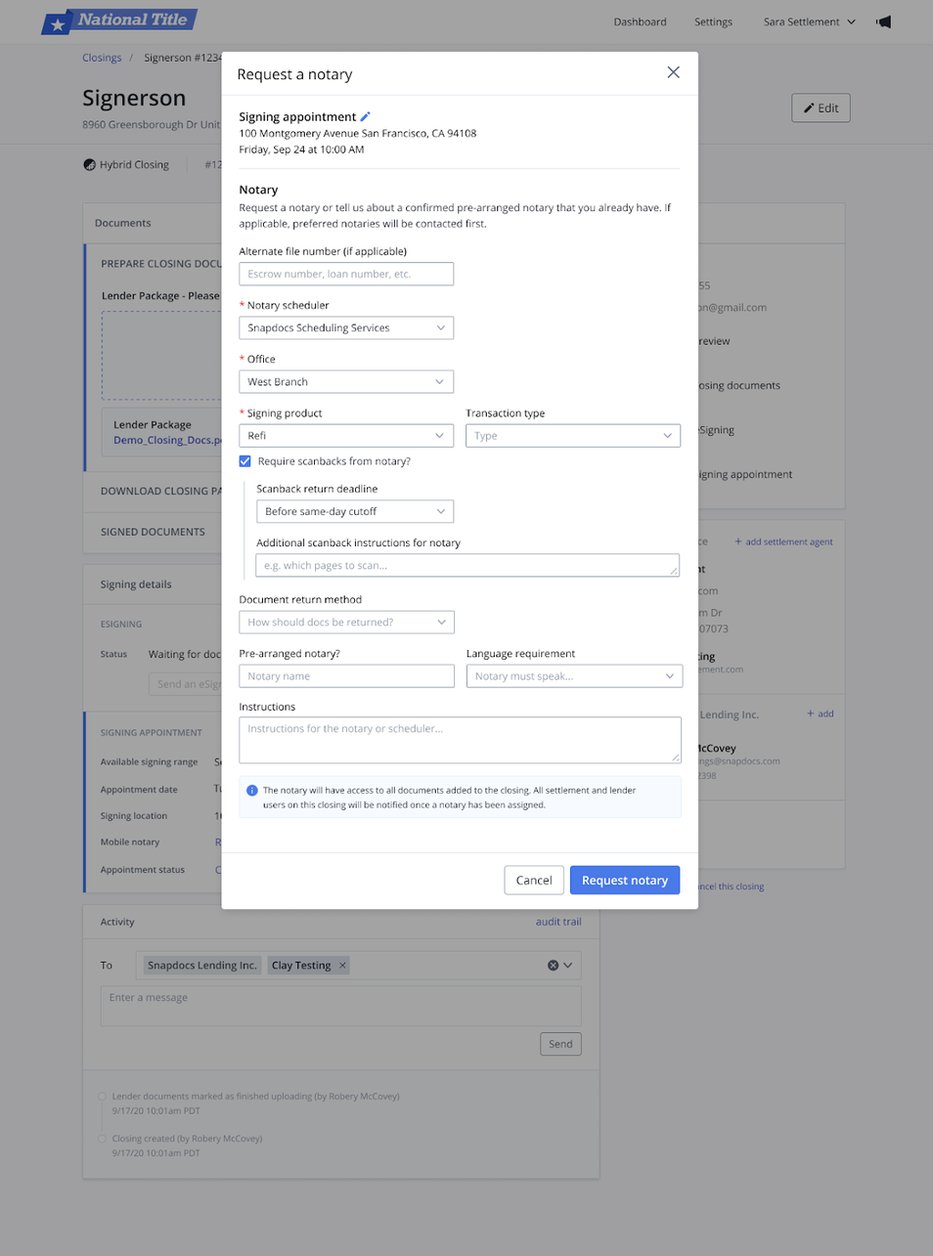

Notary Connect - Updated the Notary Request form to improve the consistencies

Below is the updated Notary Request form:

When the appointment details have been set:

July 19, 2022 Product Updates

Enhancements

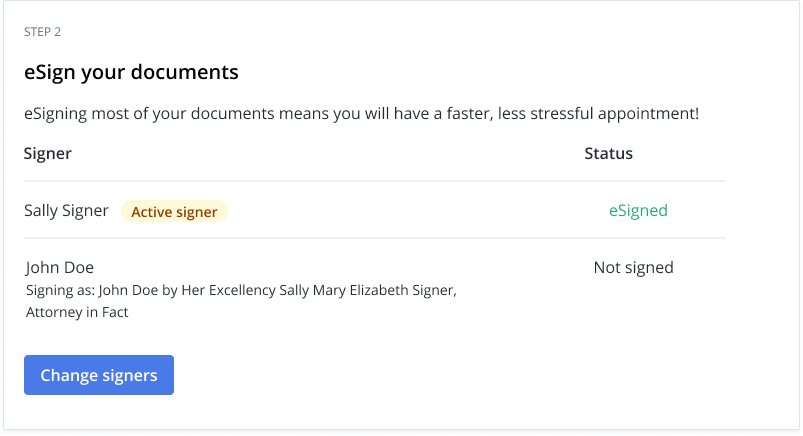

Improved the consumer’s closing view to display the signature name

Below is the example UI:

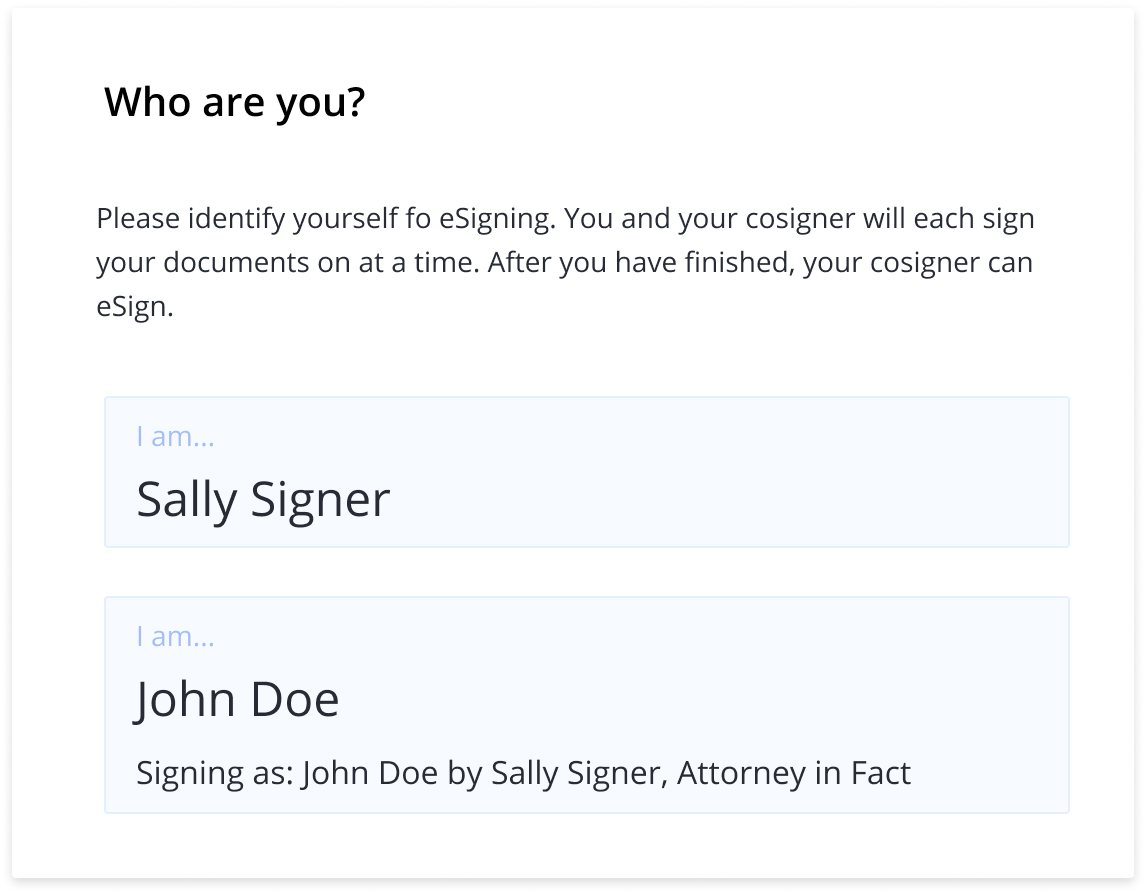

Improved the “Who are you” modal to display the signature name

Below is the example UI:

Bug Fixes

We fixed the following issues:

Emails sent to the consumers for reviewing and eSigning documents contained a broken link to the support page.

August 2022, Product Launch

Multi-Company User Support

This enhancement to Snapdocs will allow users to be members of multiple companies in Snapdocs. Lenders who have multiple Snapdocs instances or who work with brokers will benefit from this improvement which will allow their users to easily sign in to and switch between their companies within Snapdocs.

How to get started

No action is needed. Starting on August 8th, this functionality will be live for all lenders. If you have existing users that need to have their accounts consolidated, feel free to reference this Help Center article to assist with that process.

Now Available for Early Access

Snapdocs provides early product access to a select group of mortgage lenders. Participating lenders can try upcoming features and provide feedback while the functionality is still in development. The following were advertised in the July Product Launch, and because of overwhelming interest, we wanted to share them in the August Product Launch!

Lender Integrations: Byte Integration

Snapdocs integration with Byte will enable Lenders using Byte as their LOS to power their closings with Snapdocs. With this integration, Lenders will be able to create a closing, send data & documents, return signed documents, receive closing status updates and perform full redraws all within Byte.

How to get started

If you are interested in learning more about the integration, please reach out to your Customer Success Manager.

Click here to request access to this feature.

Custom Signature Name, Trust & POA Support

Closing creators can specify the borrower’s preferred signature name during the closing creation process. If provided, Snapdocs will use this signature name to annotate the eSign documents. This feature can support Trusts, POAs, or any situation where a borrower is signing by any non-standard name on a Hybrid closing.

How to get started

Reach out to your Snapdocs Customer Success Manager for more details about the feature. This feature is available for all lenders.

Click here to request access to this feature.

Loan Officers eSigning Closing Documents

With this update we will support the LO’s ability to eSign key closing documents within the Snapdocs platform. By simply sending us the LO’s name & email during closing creation, we give the LO access to eSign the same package as the borrower. This allows us to deliver back to you a fully executed closing package and save your operations team valuable time in chasing down these signatures.

How to get started

Reach out to your Snapdocs Customer Success Manager for more details about the feature. All lenders who use Ellie Docs are eligible for Early Access.

Click here to request access to this feature.

eVault

Snapdocs has designed a purpose-built eVault with hyper-reliability, ease of use, automation, and interoperability as core tenets to solve the common pain points that many lenders and investors have been facing. Our eVault is expected to launch in October 2022. To prepare for our launch, Snapdocs is looking for customers to participate in Early Access to implement and scale eNote using the new Snapdocs eVault.

How to get started

If you are interested in partnering with us as an eVault Early Access customer, reach out to your Snapdocs Customer Success Manager. All lenders are eligible for Early Access.

Click here to request access to this feature.

August 02, 2022 Product Updates

Enhancements

Snapdocs Connect APIs - Supports Secure Signed Document Downloads for Dual-Borrowers

We updated the documents resource so that each borrower in a dual-borrower closing can download only the documents containing their information. This update is governed by the Consumer can download signed documents feature:

- If enabled, borrowers can download only their own version of the esigned_dual_borrower_combined_documents.

- If not enabled, borrowers cannot download signed documents, regardless of the closing's dual-borrower status.

Snapdocs Connect APIs – Updated Lender Email Settings

We added the following email settings:

- Consumer opted into eSigning

- Signed documents ready for download

- Signed documents changed post download

- Fresh secure access link

- Appointment canceled

Lender admins can configure these email settings by clicking on Settings > Emails.

Bug Fix

We fixed the issue in closings with three or more borrowers, where two share an email and the third borrower has their own email, the borrower with the unique email was dropped from the closing.

The fix allows all signers who share the email address to be displayed at the top of the Consumer Journey. When two or more emails are shared among signers, the system will not allow the closing creation.

September 13, 2022 Product Updates

Enhancements

Snapdocs Connect API improvements

- Added an endpoint to the Snapdocs Connect API that allows a user to remove a Settlement Agent or Company Team Member from a closing.

- Added an endpoint to the Snapdocs Connect API that allows a user to modify the closing type.

Bug Fixes

- Fixed an issue that caused some event log entries to be hidden from the Snapdocs Closings page.

October 4, 2022 Product Updates

Bug Fixes

- Team members that are removed from the closing in Snapdocs no longer appear on the closing dashboard view.

- Fixed issue with redraw package not being processed until page reload.

- Fixed issue if all consumers on a hybrid closing get marked as non-eSigning consumers, we will automatically convert the closing to wet.

October 18, 2022 Product Updates

Enhancements

Quality Controller Role

Added a new role in Snapdocs called “Quality Controller”. This role is intended to receive emails regarding CQC reports and is automatically enabled for those notifications. The Lender can modify this in their settings under the email configuration.

Support Loan Purpose for eFolder

When using our integration to send scanbacks back to Encompass in a designated eFolder, lenders can now name documents (i.e. alias) with the closing's corresponding "loan purpose." This behavior matches existing functionality that allows lenders to add "loan type" and "state" to the classification name. Reach out to your CSM to enable this as the change requires action on the part of Snapdocs.

Team Page Redesign

Lenders will now be able to sort, filter, and export their user lists from within the Snapdocs platform.

November 15, 2022 Product Updates

Enhancements

CQC Improvements

Snapdocs will now display in the QC report the page count of documents in a specific classification. Previously, Snapdocs only showed a page count for the “unclassified” documents.

Additionally, previously when CQC was enabled Snapdocs would run QC on all closings currently “open.” We will now only run them on the last 6 months of closings in order to ensure performance.

New CAPI fields

CAPI now includes loan_amount and property_sale_price fields as optional fields that can be used by the customer.