COVID-19 threw the world a giant curveball in 2020. For the mortgage industry,

Lending technology accelerated by years over the course of the eight months since quarantine measures began. Looking ahead, industry advancements for 2021 could be less about novel innovation and more about building on the progress of the past year, with hybrid digital closings taking up a larger share of mortgage transactions.

"Last year there were about 129,000 loans executed digitally. We have recently been running at as much as 50,000 per week. That's 1 million annualized," Brian Madocks, CEO of eOriginal, said in an interview. "It's been a huge leap forward in terms of total loan volume and a way greater number of participants with more and more coming on. We expect 2021 to be the continuation of that, because it's still in the early stages of digital conversion for the mortgage industry."

Real estate brokerage Realogy, too, reported that its

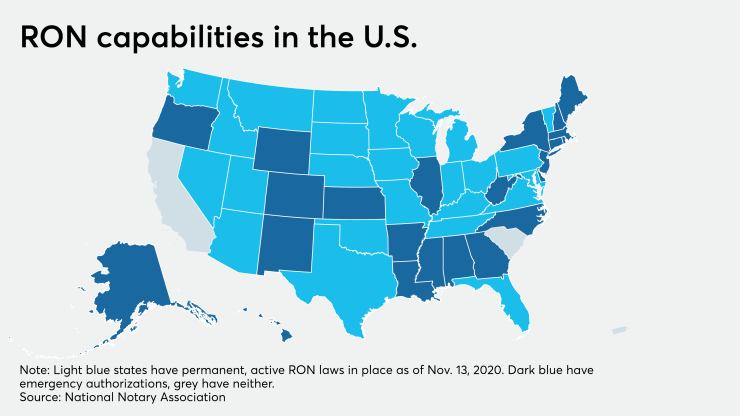

A total of 25 states have permanent RON laws in place as of Nov. 13, growing from 14 at the beginning of 2020, according to the National Notary Association. Three more — Alaska, Colorado and Hawaii — will have theirs go into effect Jan. 1, 2021 and Louisiana's will be live Feb. 1, 2022. Aside from California and South Carolina, the rest approved temporary emergency authorizations.

"I expect at least 30% of all U.S. closings in 2021 to be hybrid in nature, driving massive efficiency across the board and creating a much improved borrower experience," said Aaron King, CEO of Snapdocs. "On the other hand, the lack of standardization means RON will continue on its 20-year voyage of still not making into the mainstream."

While remote notarization still has a ways to go, it's an important tool for conducting transactions while social distancing measures remain in place. While some state governments take time in passing RON legislation, a growing list of companies offer their own capabilities or have integrated with one of the eight

Linking the numerous pieces of the home financing process makes it less disjointed for consumers. In turn, making loan obtainment easy for borrowers drives business for lenders.

"If we're to improve the mortgage process in 2021, technology must play a critical role in connecting all parties," King said. "Lenders that can only close on paper will be left behind next year, and a number of companies will fail because of their

Many industry experts predict lending in 2021 — both the activity and technology — will be a redux of 2020, continuing the frothy demand and advancements in digitization.

"2021 is going to separate the wheat from the chaff when it comes to those who claim they're building tech-enabled companies and those who actually are," said Karl Jacob, CEO of LoanSnap. "You just can't hire your way out of the mess a lot of these mortgage companies got themselves into. Given interest rates are going to stay low, I worry 2021 is going to be this reckoning around companies that can actually thrive in an environment where volume continues to stay extremely high."